The Main Principles Of Pkf Advisory Services

The Main Principles Of Pkf Advisory Services

Blog Article

Pkf Advisory Services for Dummies

Table of ContentsExamine This Report about Pkf Advisory ServicesNot known Incorrect Statements About Pkf Advisory Services Pkf Advisory Services Fundamentals ExplainedThe Ultimate Guide To Pkf Advisory ServicesThe Main Principles Of Pkf Advisory Services

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Most individuals these days know that they can not count on the state for more than the absolute basics. Planning for retired life is an intricate organization, and there are many different options readily available. A financial adviser will not only help sort with the several policies and item options and aid construct a profile to maximise your long-term leads.

Getting a home is just one of the most costly choices we make and the large majority of us need a home loan. A monetary advisor might save you thousands, particularly at times similar to this. Not just can they look for out the finest rates, they can help you analyze reasonable degrees of borrowing, take advantage of your deposit, and could likewise discover loan providers who would certainly or else not be offered to you.

Some Ideas on Pkf Advisory Services You Should Know

An economic advisor recognizes just how products operate in different markets and will certainly identify possible downsides for you in addition to the potential advantages, so that you can after that make an informed decision concerning where to invest. As soon as your risk and financial investment assessments are total, the next action is to take a look at tax obligation; even the many basic review of your placement might aid.

For more challenging arrangements, it could indicate moving possessions to your partner or children to maximise their personal allocations instead - PKF Advisory Services. An economic adviser will certainly always have your tax setting in mind when making suggestions and factor you in the right instructions also in complex scenarios. Also when your investments have actually been implemented and are running to plan, they need to be kept track of in situation market growths or abnormal events push them off program

They can analyze their efficiency versus their peers, make certain that your asset allowance does not become distorted as markets vary and assist you combine gains as the due dates for your best goals move closer. Money is a challenging topic and there is lots to think about to secure it and make the many of it.

Excitement About Pkf Advisory Services

Using an excellent monetary advisor can puncture the buzz to steer you in the best direction. Whether you need basic, functional recommendations or a professional with committed knowledge, you could find that in the long-term the cash you purchase experienced suggestions will certainly be paid back lot of times over.

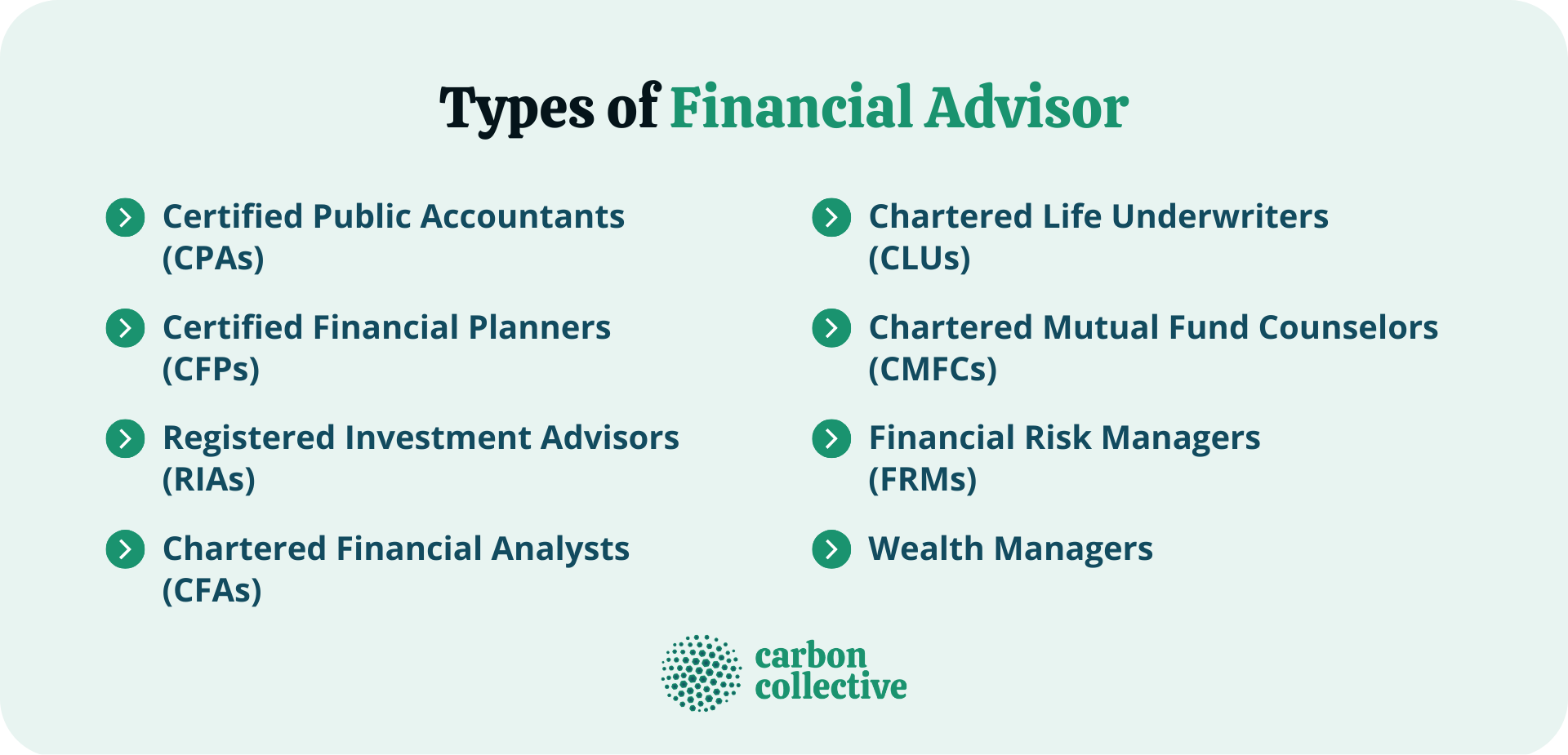

Maintaining these licenses and accreditations requires continual education, which can be pricey and lengthy. Financial consultants need to remain updated with the most recent sector patterns, regulations, and ideal practices to offer their clients effectively. In spite of these challenges, being a qualified and certified monetary advisor supplies immense advantages, including many profession possibilities and greater making possibility.

The smart Trick of Pkf Advisory Services That Nobody is Talking About

Compassion, analytical abilities, behavior finance, and exceptional interaction are critical. Financial consultants function carefully with customers from diverse backgrounds, aiding them navigate complicated monetary choices. The capacity to pay attention, understand their distinct requirements, and give customized advice makes all the browse around this site difference. Interestingly, prior experience in financing isn't always a prerequisite for success in this area.

I started my occupation in business money, walking around and upwards throughout the company financing framework to refine abilities that prepared me for the function I am in today. browse around this site My selection to relocate from business finance to personal money was driven by personal demands along with the need to assist the numerous individuals, families, and tiny companies I currently offer! Accomplishing a healthy work-life balance can be testing in the very early years of a monetary expert's profession.

The economic advising career has a positive expectation. It is expected to grow and evolve continually. The task market for personal economic consultants is predicted to expand by 17% from 2023 to 2033, suggesting solid need for these services. This development is driven by elements such as a maturing population requiring retirement planning and boosted understanding of the importance of monetary planning.

Financial advisors have the special ability to make a substantial influence on their customers' lives, helping them accomplish their financial goals and safeguard their futures. If you're passionate regarding finance and assisting others, this job path could be the excellent fit for you - PKF Advisory Services. To check out even more information regarding coming to be a financial consultant, download our detailed FAQ sheet

Pkf Advisory Services Fundamentals Explained

If you would certainly such as investment guidance regarding your specific realities and conditions, please contact a competent financial consultant. Any kind of financial investment includes some degree of risk, and various types of financial investments include varying levels of risk, consisting of loss of principal.

Past efficiency of any security, indices, approach or appropriation may not be like it indicative of future outcomes. The historical and present details as to regulations, laws, standards or advantages included in this record is a summary of info gotten from or prepared by other resources. It has actually not been separately validated, but was acquired from resources thought to be reputable.

A financial advisor's most useful property is not know-how, experience, and even the ability to produce returns for customers. It's trust, the foundation of any successful advisor-client partnership. It establishes an advisor aside from the competitors and maintains customers coming back. Financial experts throughout the nation we talked to concurred that trust is the crucial to constructing lasting, productive connections with customers.

Report this page